Is understanding your business’s financial pulse a source of anxiety? Do financial statements leave you feeling more confused than empowered? Fear not, financial sleuths and business owners alike!

This blog post dives into the realm of Diagnosing the Financial Health of Business courses, providing a roadmap to navigate the diverse options available and discover the perfect fit for your needs.

Whether you’re a passionate entrepreneur striving to secure funding, a seasoned manager seeking to optimize performance, or an employee aiming to gain financial literacy, understanding the financial health of your business is crucial.

These courses equip you with the knowledge and tools to analyze financial statements, assess risk, identify strengths and weaknesses, and ultimately make informed decisions for your business’s future.

So, put on your financial detective hat, sharpen your analytical skills, and get ready to embark on a journey toward financial clarity and confidence!

Overview: Diagnosing The financial Health Of A Business

This course is designed to teach learners how to assess and understand the financial well-being of a business. Ideal for small business owners, entrepreneurs, and anyone interested in finance or considering starting a business, this course covers the basics of financial statements, key financial ratios, and indicators that signal the health of a business. Through straightforward explanations, practical examples, and hands-on exercises, participants will learn how to use financial information to make informed decisions about business operations and strategy.

Course Syllabus Preview:

Our course syllabus is structured to ensure a comprehensive understanding of diagnosing a business’s financial health, making it accessible and actionable for all learners. Here’s an overview of the major topics and their subtopics:

I. Introduction to Business Finance

- Understanding Financial Statements

- The Importance of Financial Health

- Basic Accounting Concepts

II. Analyzing Financial Statements

- Income Statement Analysis

- Balance Sheet Analysis

- Cash Flow Statement Analysis

III. Key Financial Ratios

- Profitability Ratios

- Liquidity Ratios

- Solvency Ratios

- Efficiency Ratios

IV. Other Indicators of Financial Health

- Debt Levels and Debt Management

- Revenue Growth and Profit Margins

- Cash Flow Trends

V. Tools for Financial Analysis

- Software and Tools for Financial Diagnostics

- Benchmarking Against Industry Standards

- Forecasting and Projections

VI. Making Informed Business Decisions

- Interpreting Financial Data for Decision Making

- Identifying Areas for Improvement

- Planning for Financial Stability and Growth

What You Will Learn

By joining this course, participants will gain:

- Financial Literacy: Understand how to read and interpret financial statements to assess a business’s financial situation.

- Analytical Skills: Learn how to calculate and analyze key financial ratios and other indicators of financial health.

- Decision-Making Tools: Gain insights into using financial analysis for strategic business decisions and planning.

- Problem-Solving Abilities: Develop the ability to identify financial issues and opportunities for improvement.

- Planning for the Future: Understand how to use financial forecasts and projections to plan for business growth and stability.

This Course Includes:

- 10 Hours of On-Demand Video: Engaging video lectures that provide in-depth coverage of diagnosing financial health.

- 5 Comprehensive Articles: Supplementary reading materials to enhance your understanding of business finance.

- 8 Downloadable Resources: Access to templates, financial ratio calculators, and guides to support your analysis.

- Mobile and TV Access: Study from anywhere, anytime, with lessons available on both mobile and TV.

- Certificate of Completion: Showcase your commitment to learning and your newly acquired skills in financial analysis.

Top 3 Alternative To Diagnosing The Financial Health Of A Business

Here are the top 5 alternatives to financial analysis for business courses online:

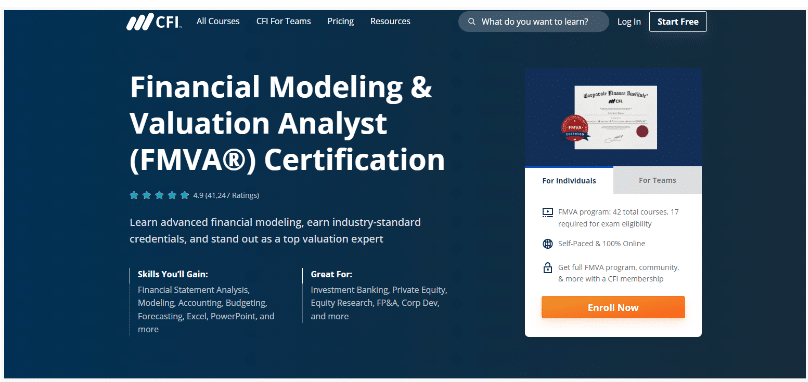

1. Financial Modeling And Valuation Analysis By CFI

| Course Link | Here |

| Pricing | $597/year membership |

This course focuses on financial modeling, a critical skill for financial analysis.

– What it offers:

The course provides comprehensive financial modeling training, including practical Excel applications.

– What will I learn?

Participants will learn practical Excel modeling skills, financial analysis, accounting, presentation skills, and valuation methods.

– Where could this lead me?

Completion of this course could lead to improved financial modeling skills, enhanced career prospects, and the ability to deliver high-quality financial analysis.

2. Financial Analysis And Analytics

| Course Link | Here |

| Pricing | £545.00 |

This course focuses on financial analysis and analytics, providing foundational knowledge and awareness of how to use financial analysis and data analytics.

– What it offers:

The course provides practical insights for financial analysis and analytics using lecture presentations, group work, short videos, and case studies.

– What will I learn?

Participants will learn about financial statements, transactions, investment decisions, and forecasting techniques, among other topics.

– Where could this lead me?

Completion of this course could lead to improved financial analysis and analytics skills, enhanced career prospects, and the ability to apply financial analysis and data analytics in various contexts.

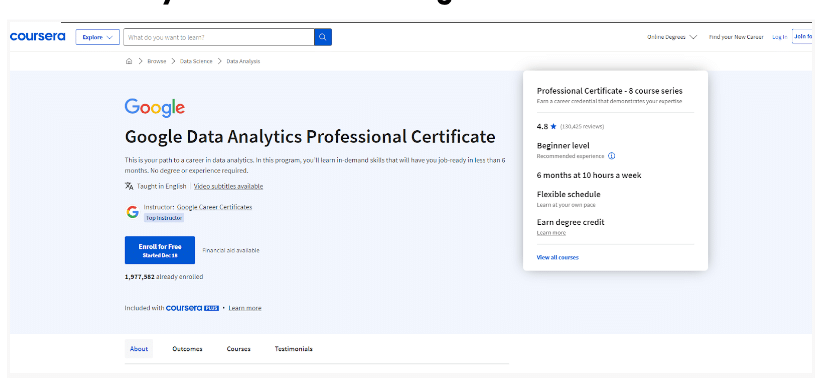

3. Data Analytics Certification Programs

| Course Link | Here |

| Pricing | Free |

This course focuses on data analytics certification programs, providing specialized knowledge in data analytics.

– What it offers:

The course provides a list of the best data analytics certification programs, including the CareerFoundry Data Analytics Program, Springboard Data Analytics Career Track, and Wharton Business Analytics Certification.

– What will I learn?

Participants will learn about data analytics, including predictive analytics, data mining, and data visualization, among other topics.

– Where could this lead me?

Completion of these certification programs could lead to improved data analytics skills, enhanced career prospects, and the ability to apply data analytics in various contexts.

Related Read:

Conclusion

The vast array of Diagnosing the Financial Health of Business course can feel overwhelming. This post has hopefully served as a compass, guiding you toward the right fit.

Remember, your personal learning style, desired outcomes, and business context should all influence your decision.

Don’t be afraid to delve deeper! Research course outlines instructors’ credentials and student reviews to find the program that resonates with you.

Investing in this valuable knowledge empowers you to diagnose and optimize your business’s financial health, paving the way for a flourishing and sustainable future.

So, take the first step towards financial mastery, choose the course that ignites your learning journey, and remember: a healthy financial diagnosis leads to a thriving business!

Article By