This guide unlocks a treasure chest of curated courses, each designed to transform you from a financial newbie to a master-of-your-money superhero.

Budgeting basics, investing hacks, debt-busting tricks – it’s all at your fingertips, ready to empower your financial journey.

Ready to ditch the money stress and unlock your financial potential? Join me as I explore these awesome courses and map out your path to financial freedom – because everyone deserves to feel confident and in control of their money!

Overview: Financial Literacy

This course is designed to empower individuals with the knowledge and skills needed to make informed and effective decisions with their financial resources.

Ideal for beginners and those looking to strengthen their financial foundation, this course covers everything from basic money management to investing, saving for retirement, and understanding credit.

Through easy-to-understand language and practical examples, students will learn how to manage their finances confidently and achieve their financial goals.

Course Syllabus Preview:

Our course syllabus is carefully crafted to ensure a comprehensive understanding of financial literacy, making complex concepts accessible to all. Here’s a snapshot of the major topics and their subtopics:

I. Introduction to Financial Literacy

- The Importance of Financial Literacy

- Basic Financial Terminology

- Setting Financial Goals

II. Budgeting and Money Management

- Creating and Managing a Budget

- Understanding Income and Expenses

- Saving Strategies and Emergency Funds

III. Banking and Financial Institutions

- Types of Bank Accounts

- How to Choose a Bank or Credit Union

- Understanding Bank Fees and Statements

IV. Credit and Debt Management

- Understanding Credit Scores and Reports

- Types of Loans and Interest Rates

- Strategies for Paying Off Debt

V. Investing Basics

- Introduction to Investing

- Types of Investments (Stocks, Bonds, Mutual Funds)

- Risk and Return

VI. Retirement Planning

- Understanding Retirement Accounts (401(k), IRA)

- Planning for Retirement Savings

- Social Security and Pension Basics

VII. Insurance and Risk Management

- Types of Insurance (Health, Life, Auto)

- How Insurance Works

- Evaluating Insurance Needs

VIII. Taxes and Personal Finance

- Basics of Income Tax

- Tax-Advantaged Accounts and Benefits

- Filing Taxes

What You Will Learn

By joining this course, participants will gain:

- Budgeting Skills: Learn how to create and stick to a budget to manage your finances effectively.

- Understanding of Credit: Gain insights into how credit works, how to build good credit, and how to manage debt responsibly.

- Investment Knowledge: An introduction to the basics of investing to help you grow your wealth over time.

- Retirement Planning: Understand the importance of retirement planning and how to start saving for your future.

- Insurance Awareness: Learn about different types of insurance and how to protect yourself and your assets.

The Ultimate Guide to Top 6 Financial Literacy Courses: Empower Your Financial Future

In today’s fast-paced world, understanding and managing your finances is more crucial than ever.

Financial literacy courses offer a beacon of knowledge, guiding you through personal finance, investment, debt management, and more complexities.

This guide delves into some of the best online courses, helping you make informed decisions about your financial future.

1. Personal Finance 101 On Udemy

| Course Link | Here |

| Pricing | Free |

“Personal Finance 101” on Udemy is a comprehensive introduction to personal finance, covering budgeting, saving, investing, and more.

What Does It Offer?

Udemy’s platform provides an interactive learning experience with video lectures, quizzes, and practical exercises.

Curriculum Breakdown:

- Module 1: Introduction to Personal Finance

- Understanding the importance of personal finance.

- Setting financial goals.

- Module 2: Budgeting and Financial Planning

- Creating a personal budget.

- Managing expenses and income.

- Module 3: Saving and Investing

- Exploring different savings options.

- Introduction to basic investment concepts.

- Module 4: Credit and Debt Management

- Understanding credit scores and reports.

- Strategies for effective debt management.

Unique Teaching Methodologies:

- Video Lectures: Engaging video content to explain complex financial concepts.

- Quizzes: Interactive quizzes to assess your understanding.

- Practical Exercises: Hands-on activities to apply what you’ve learned.

What Will I Learn?

By completing this course, you’ll have the knowledge and skills to:

- Create a personal budget.

- Understand savings accounts and investments.

- Grasp the basics of credit scores.

Where Could This Lead Me?

This course sets the foundation for enhanced personal finance management skills and better financial decision-making, and it even serves as a stepping stone for more advanced financial studies.

2. McGill Personal Finance Essentials

| Course Link | Here |

| Pricing | Free |

The McGill Personal Finance Essentials course focuses on providing essential knowledge about managing personal finances effectively.

What Does It Offer?

High-quality video content.

- A wide range of financial topics is covered.

Curriculum Breakdown:

- Module 1: Understanding Personal Finance

- Introduction to financial concepts.

- Setting financial goals.

- Module 2: Budgeting and Saving

- Creating and managing a budget.

- Saving strategies.

- Module 3: Investing Basics

- Introduction to investments.

- Risk assessment and diversification.

- Module 4: Debt Management

- Types of debt and strategies for repayment.

- Credit scores and reports.

What Will I Learn?

While detailed information is limited, you can expect to gain a solid foundation in personal finance essentials.

Where Could This Lead Me?

The course likely leads to improved financial literacy and better personal finance management.

3. Financial Planning For Young Adults On Coursera

| Course Link | Here |

| Pricing | Free |

This course, offered by the University of Illinois on Coursera, introduces young adults to the basics of financial planning, helping them make informed decisions about their finances.

What Does It Offer?

The course uses a mix of video lectures, readings, and practical exercises to teach financial concepts.

Curriculum Breakdown:

- Week 1: Setting Financial Goals

- Defining financial goals.

- The importance of financial planning.

- Week 2: Budgeting and Saving

- Creating a budget.

- Effective savings strategies.

- Week 3: Credit and Debt Management

- Understanding credit scores.

- Strategies for responsible credit use.

- Week 4: Investing and Retirement Planning

- Introduction to investing.

- Retirement planning basics.

Unique Teaching Methodologies:

- Video Lectures: Engaging video content to explain financial concepts.

- Readings: Supplemental readings to deepen understanding.

- Practical Exercises: Real-world exercises to apply what you’ve learned.

What Will I Learn?

By completing this course, you’ll gain insights into financial goals, budgeting, credit management, and investment basics tailored for young adults.

Where Could This Lead Me?

This course can set you on the path to early financial independence, informed financial decisions, and a solid foundation for future wealth accumulation.

4. Introduction To Managing Your Personal Finance Debts On Alison

| Course Link | Here |

| Pricing | Free |

This course focuses on managing and reducing personal debt effectively, a critical aspect of personal finance.

What Does It Offer?

Alison’s course provides insights into different types of debt, strategies for repayment, and how to avoid common debt traps.

Curriculum Breakdown:

- Module 1: Understanding Debt

- Introduction to personal debt.

- Types of debt and their characteristics.

- Module 2: Managing Debt

- Strategies for managing debt effectively.

- Debt consolidation and refinancing.

- Module 3: Debt Reduction and Avoidance

- Techniques for reducing debt.

- Avoiding common debt pitfalls.

Unique Teaching Methodologies:

- Video Lessons: Informative video content to explain debt-related concepts.

- Interactive Assessments: Quizzes and assessments to reinforce learning.

What Will I Learn?

This course equips you with techniques for managing debts, improving credit scores, and planning your finances to avoid future debt.

Where Could This Lead Me?

Completing this course can lead to improved financial health, freedom from debt, and knowledge to make better financial choices.

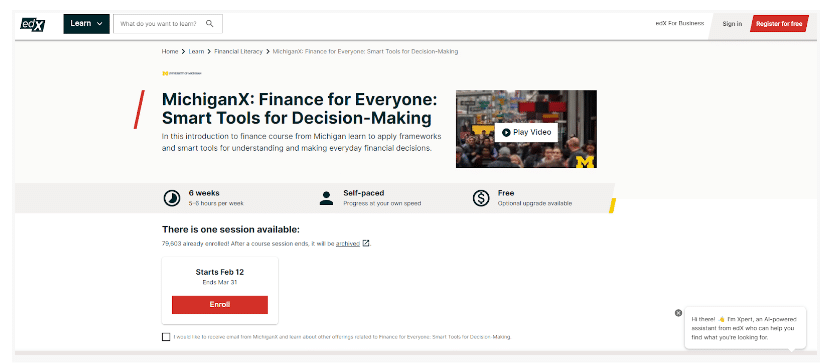

5. Finance For Everyone: Smart Tools For Decision-Making by the University of Michigan

| Course Link | Here |

| Pricing | Free |

“Finance for Everyone” is an online course offered by the University of Michigan through edX. It aims to demystify the world of finance and make it accessible and applicable to everyday life. This course focuses on improving financial literacy and decision-making by providing practical tools and frameworks.

What Does It Offer?

The course offers a 6-week, self-paced learning experience, requiring approximately 5-6 hours of study per week. It provides access to a variety of resources, including video lectures, readings, and interactive exercises.

Curriculum Overview:

- Week 1: Time Value of Money

- Introduction to the concept of time value of money (TVM).

- Understanding how TVM affects financial decisions.

- Week 2: Renting vs. Buying

- Exploring the decision-making process between renting and buying.

- Analyzing the financial implications of housing choices.

- Week 3: Evaluating Loans

- Understanding different types of loans.

- How to evaluate loans and make informed borrowing decisions.

- Week 4: Saving and Investing

- Introduction to saving and investing principles.

- Exploring investment options and strategies.

- Week 5: Allocating Resources in a Value-Added Way

- Strategies for allocating resources effectively.

- Maximizing value in financial decisions.

- Week 6: Final Project and Course Conclusion

- Applying the knowledge gained throughout the course to a practical final project.

Unique Teaching Methodologies:

- Video Lectures: Engaging video lectures that simplify complex financial concepts.

- Readings: Supplemental readings to deepen understanding.

- Interactive Exercises: Practical exercises to apply financial concepts.

- Final Project: An opportunity to apply what you’ve learned to a real-world financial decision.

What Will I Learn?

By completing this course, you’ll gain essential knowledge, skills, and tools of finance that can be applied in both personal and professional situations. You’ll also develop frameworks for decision-making and learn how to think clearly about significant financial choices.

Where Could This Lead Me?

This course can lead to improved financial decision-making, whether you’re making personal financial choices, managing finances for a business, or seeking a foundation for further studies in finance. It empowers you to navigate various financial situations with confidence and informed decision-making.

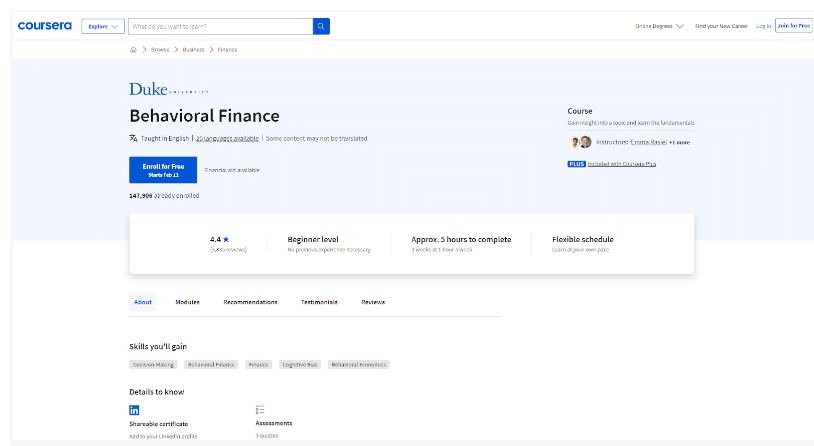

6. Behavioral Finance: Understanding the Psychology of Financial Decision Making

| Course Link | Here |

| Pricing | Free |

Behavioral Finance delves into the psychological aspects influencing financial decisions, highlighting common mistakes and biases like the tendency to sell winning investments while holding onto losers or neglecting to enroll in beneficial employer retirement plans.

What It Offers:

- An in-depth exploration of heuristics (mental shortcuts) and how they can lead to predictable financial decision-making errors.

- Insight into various biases that affect financial choices and how to avoid them.

What Will I Learn?

- Strategies for improving spending, saving, and investing decisions.

- Understanding of biases such as loss aversion, overconfidence, and others that impact financial behavior.

Where Could This Lead Me?

Equipped with the knowledge from this course, you can make more informed financial decisions, potentially leading to better investment outcomes and financial planning strategies.

Conclusion

Financial literacy is a journey, not a destination. These courses offer a starting point for anyone looking to improve their financial well-being.

By investing time in your financial education, you’re not just planning for your future; you’re transforming your present.

Take the first step towards financial empowerment by exploring these courses. Each offers unique insights and practical knowledge to help you navigate your financial path with confidence.

Article By