Financial planning courses are designed to help individuals and professionals gain the knowledge and skills necessary to manage their finances effectively.

These courses cover a wide range of topics, including investment strategies, retirement planning, tax planning and management, insurance and risk management, estate planning and wealth transfer, and behavioral finance.

They also provide an introduction to the basics of financial planning, financial planning software and tools, and professional ethics and regulation.

Investing in financial planning courses can be wise for anyone looking to improve their financial literacy, whether they are beginners or seasoned professionals.

These courses offer a comprehensive understanding of the financial planning process and equip learners with the tools and techniques needed to develop and implement effective financial plans.

Overview: Financial Planning (FinPlan)

This course is designed to guide individuals through the process of creating a comprehensive financial plan for their future. Ideal for anyone looking to get their finances in order, from young adults just starting out to those nearing retirement, this course covers essential topics such as budgeting, saving, investing, and planning for retirement.

Through clear explanations and practical examples, students will learn how to manage their money effectively, make informed financial decisions, and set themselves up for a secure financial future.

Course Syllabus Preview:

Our course syllabus is carefully structured to ensure a thorough understanding of financial planning, making it accessible and actionable for all learners. Here’s a breakdown of the major topics and their subtopics:

I. Introduction to Financial Planning

- The Importance of Financial Planning

- Setting Financial Goals

- Understanding Your Current Financial Situation

II. Budgeting and Saving

- Creating a Budget

- Tips for Effective Saving

- Emergency Funds and Why They Matter

III. Debt Management

- Understanding Different Types of Debt

- Strategies for Paying Off Debt

- Avoiding Common Debt Traps

IV. Investing Basics

- Introduction to Investing

- Types of Investments (Stocks, Bonds, Mutual Funds)

- Risk Management in Investing

V. Retirement Planning

- Estimating Retirement Needs

- Retirement Savings Accounts (401(k), IRA)

- Planning for Healthcare in Retirement

VI. Insurance and Risk Management

- Types of Insurance (Life, Health, Property)

- How to Choose the Right Insurance

- Protecting Your Assets and Income

VII. Estate Planning

- Wills and Trusts

- Beneficiaries and Estate Taxes

- Planning for the Unexpected

What You Will Learn

By joining this course, participants will gain:

- Budgeting Skills: Learn how to create and stick to a budget to manage your finances effectively.

- Debt Management Strategies: Understand how to manage and reduce debt and learn strategies to avoid accumulating more debt.

- Investment Knowledge: Gain a basic understanding of investing and how to build a diversified investment portfolio.

- Retirement Planning: Learn how to plan for retirement, including estimating your retirement needs and understanding different retirement accounts.

- Insurance Insights: Understand the importance of insurance in protecting your financial future and how to choose the right policies.

This Course Includes:

- 12 Hours of On-Demand Video: Engaging video lectures that break down complex financial planning concepts into understandable terms.

- 6 Comprehensive Articles: Additional reading materials to deepen your understanding of key financial planning topics.

- 10 Downloadable Resources: Access to templates, worksheets, and guides to support your financial planning efforts.

- Mobile and TV Access: Study from anywhere, anytime, with lessons available on both mobile and TV.

- Certificate of Completion: Showcase your commitment to improving your financial literacy and planning skills.

6 Best Financial Planning Courses You Need In 2024

Here are the top 6 financial planning courses you can take advantage of in 2024.

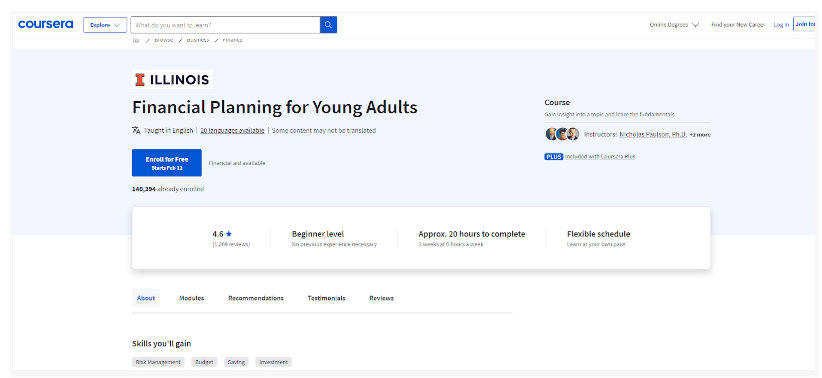

1. Financial Planning For Young Adults

| Course Link | Here |

| Pricing | Free |

Financial Planning for Young Adults (FPYA) is a course developed in partnership with the CFP Board. It’s designed to introduce young adults to basic financial planning concepts.

The course is structured around eight modules within a 4-week period, covering topics such as financial goal setting, saving and investing, budgeting, financial risk, borrowing, and credit.

- Skills Gained: Risk Management, Budgeting, Saving, Investment

- Certificate: Shareable certificate upon completion

- Assessments: 11 quizzes to test your understanding

- Flexible Schedule: Learn at your own pace with approximately 20 hours to complete over three weeks at 6 hours a week.

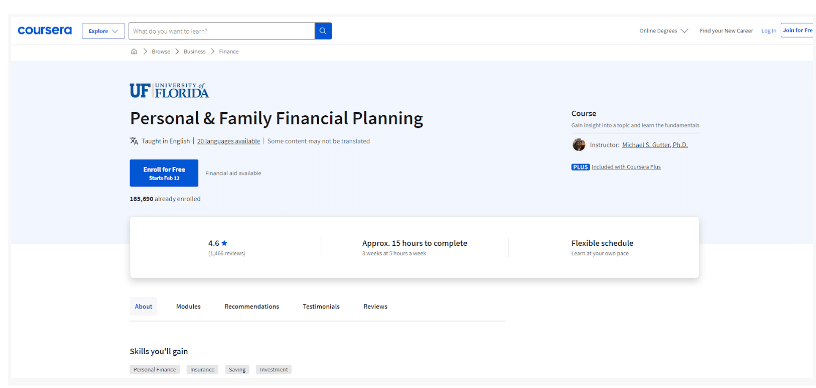

2. Personal & Family Financial Planning (University of Florida):

| Course Link | Here |

| Pricing | Free |

This course dives into personal finance fundamentals, equipping you with tools to manage your income, build wealth, and secure your future. Learn budgeting, investing, insurance, taxes, retirement planning, and building smart financial habits for life. Ideal for individuals and families at any stage of financial planning.

- Skills Gained: Finance, Financial Management, Leadership and Management, Planning, Budget Management, Financial Analysis, Financial Accounting, Risk Management, Account Management, Investment Management.

- Duration: 3 weeks

- Rating: 4.6 (1269 reviews)

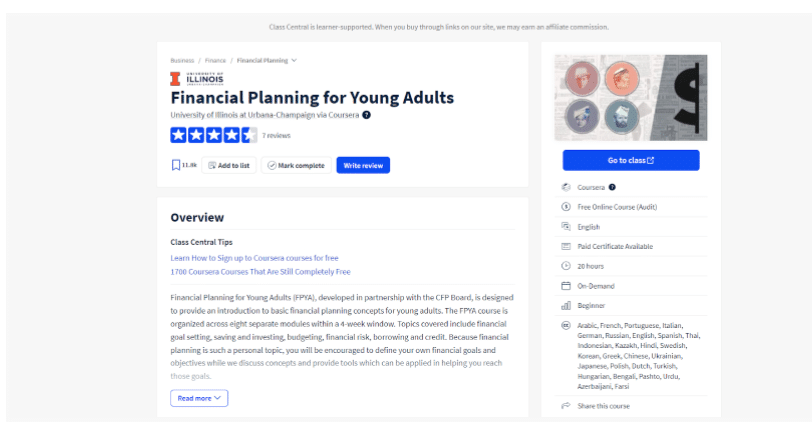

3. Financial Planning For Young Adults (University of Illinois):

| Course Link | Here |

| Pricing | Free |

Tailored for young adults, this free course covers essential financial management topics to kickstart your financial journey. Understand budgeting, saving, responsible credit use, debt management, and basic investing strategies. Gain practical skills to build a solid financial foundation for adulthood.

- Skills Gained: Finance, Financial Management, Leadership and Management, Planning, Cash Management, Decision Making, Account Management, Budget Management, Financial Analysis, Risk Management.

- Duration: 1 – 3 Months

- Rating: 4.6 (1.3K reviews)

- Status: Free

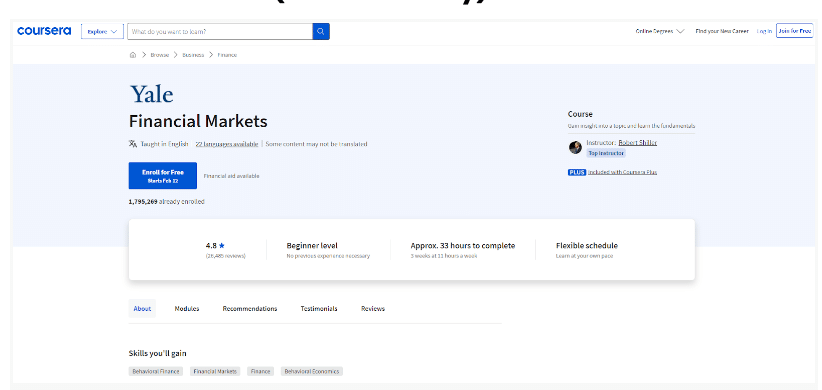

4. Financial Markets (Yale University):

| Course Link | Here |

| Pricing | Free |

Explore the exciting world of financial markets! This course delves into market structures, instruments, pricing, and analysis. Learn about stocks, bonds, derivatives, and portfolio management strategies.

Develop critical thinking and decision-making skills to navigate financial markets effectively.

- Skills Gained: Finance, Investment Management, Risk Management, Banking, Behavioral Economics, Critical Thinking, Decision Making, Financial Analysis, Innovation, Regulations and Compliance, Leadership and Management.

- Duration: 1 – 3 Months

- Rating: 4.8 (26K reviews)

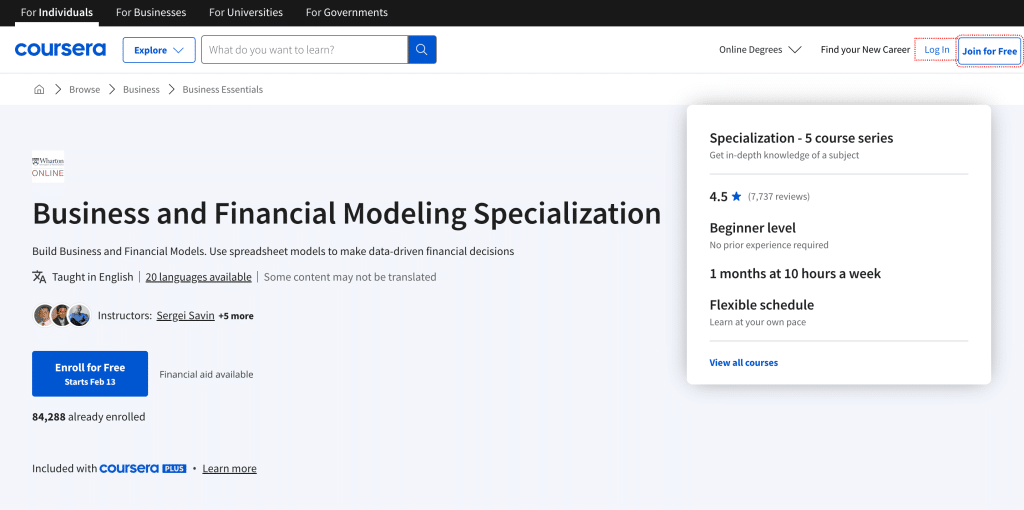

5. Business And Financial Modeling (University of Pennsylvania):

| Course Link | Here |

| Pricing | Free |

Go beyond basic finance with this comprehensive course. Master financial modeling techniques used in business analysis, forecasting, and investment decisions.

Learn data analysis, statistics, and financial accounting principles to build robust financial models in Excel. Ideal for aspiring analysts and finance professionals.

- Skills Gained: Business Analysis, Data Analysis, Finance, General Statistics, Probability & Statistics, Financial Analysis, Statistical Analysis, Forecasting, Mathematics, Spreadsheet Software, Statistical Tests, Basic Descriptive Statistics, Data Model, Mathematical Theory & Analysis, Risk Management, Correlation And Dependence, Decision Making, Investment Management, Accounting, Leadership and Management, Regression, Data Analysis Software, Financial Accounting, Microsoft Excel, Performance Management, Cash Management, General Accounting, Computer Programming.

- Duration: 3 – 6 Months

- Rating: 4.5 (11K reviews)

- Status: Free

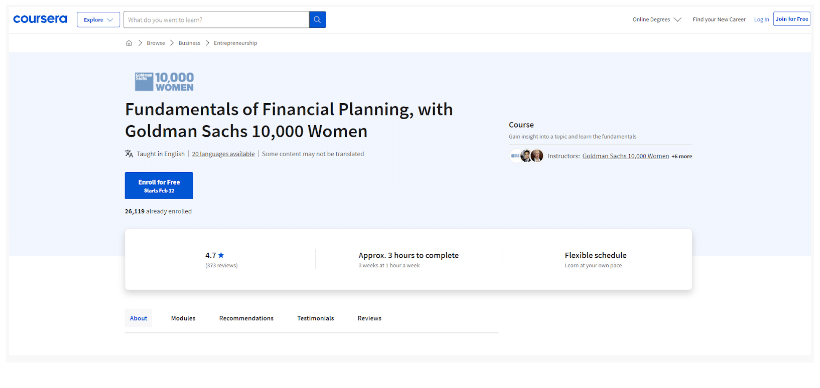

6. Fundamentals Of Financial Planning, with Goldman Sachs 10,000 Women (Goldman Sachs):

| Course Link | Here |

| Pricing | Free |

This introductory course, offered by Goldman Sachs, empowers women with financial planning knowledge. Learn budgeting, saving, investing basics, and financial goal setting. Gain tools and confidence to manage your finances effectively and achieve your financial goals.

- Skills Gained: Finance, Financial Management, Forecasting.

- Duration: 1 – 4 Weeks

- Rating: 4.7 (373 reviews)

Conclusion

In summary, financial planning courses offer invaluable insights and skills for personal and professional growth. Platforms like Coursera provide flexible, comprehensive training from top institutions, catering to a wide audience.

Whether you’re starting out, upskilling, or changing careers, these courses equip you with essential financial knowledge and open doors to numerous opportunities in finance and beyond.

Investing in such education is an investment in your future, empowering you to manage finances effectively and achieve your career goals.

Embrace the journey towards financial literacy and explore the course that aligns with your aspirations.

Article By